How Does Pet Insurance Work?

We’ve all heard of human health insurance, but have you ever considered health insurance for your pets? An up-and-coming industry, pet insurance is something many pet owners are starting to choose to spend their money on and with the price of an average emergency vet bill being $800 to $1500, it’s no surprise why! We’ve compared several well-known companies and broken down the pros and cons of pet insurance to help you decide if pet insurance is a good investment for your family.

Terms to Know

While pet insurance terms are pretty similar to human health insurance terms, it never hurts to start with a refresher. Here are some insurance terms to keep in mind from the National Association of Insurance Commissioners:

Accident Insurance – Insurance for unforeseen bodily injury.

Claim – A request made by the insured for insurer remittance of payment due to loss incurred and covered under the policy agreement.

Deductible – Portion of the insured loss (in dollars) paid by the policy holder.

Limited Policies – Health insurance coverage for a certain ailment, such as cancer.

Pet Insurance Plans – Veterinary care plan insurance policy providing care for a pet animal (e.g., dog or cat) of the insured owner in the event of its illness or accident.

Policy – A written contract ratifying the legality of an insurance agreement.

Premium – Money charged for the insurance coverage reflecting expectation of loss.

How Much Does Pet Insurance Cost?

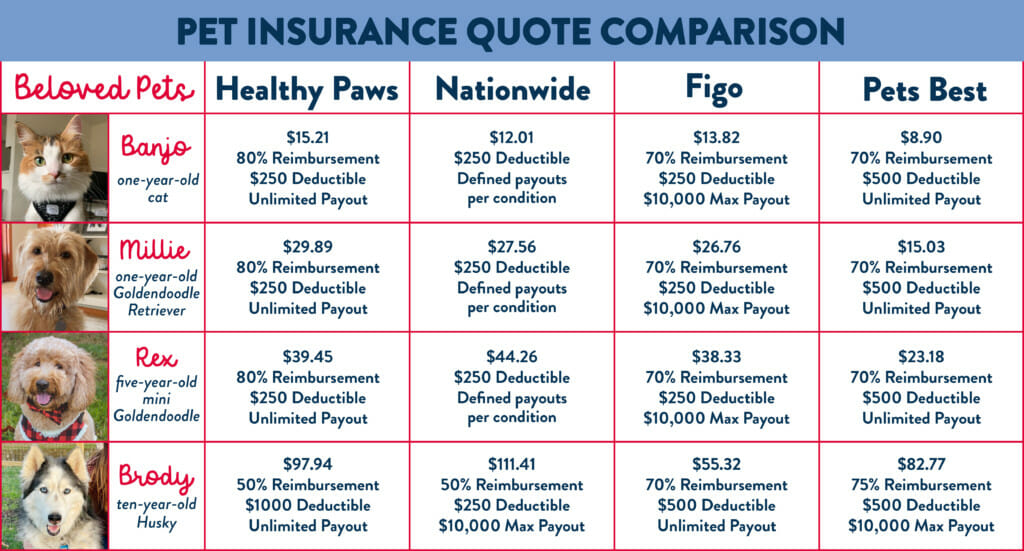

The cost of pet insurance depends on many factors, the most important being your pet’s age. However, cost and coverage varies significantly between different insurance companies as well. To get an idea of how much different companies charge monthly for different ages and breeds, I sacrificed my inbox and rounded up quotes for four of our office pets–Banjo, Millie, Rex, and Brody:

As you can see, the age of your pet makes a huge difference in how much your monthly cost will be. Coverage for puppy Millie is almost a fourth of the price of coverage for senior Brody. It should be noted, though, that while I tried to make the quotes as comparable as I could, you’ll see that the deductible, reimbursement, and payouts all varied slightly from age to age and company to company.

Another thing to note is that just like human insurance, your pet’s monthly insurance premium isn’t locked in for life. @adventures.with.willow’s mom, Rachael, experienced this first-hand when she filed a claim with Healthy Paws and watched her premiums almost double over the course of three years. Yikes! Rest assured, though–this isn’t the case with every Healthy Paws user and others told us they’ve only seen a slight increase in their monthly premium cost over a few years. Either way, make sure you realize that your premium may increase as your pet gets older and becomes more susceptible to health issues (understandably!) and don’t hesitate to shop around again if your premiums get too high.

What Does Pet Insurance Cover?

A big thing to note about pet insurance: Routine coverage–things like annual exams, vaccines, etc.–isn’t typically a part of your pet insurance coverage. “The biggest con with [our insurance company] is that it is an emergency insurance, meaning it doesn’t cover exam costs or annual costs,” explains Gabriela. Some companies like Nationwide and Pets Best do, however, offer this at an additional cost, usually about $20. Just make sure to read the fine print so you know exactly what routine services are covered.

The Pros

When asked about the pros of having pet insurance, everyone we talked to said peace of mind. “I think it’s the peace of mind that comes with knowing you can get care for your pet in an emergency or serious situation without having to worry about the cost or having to shell out thousands of dollars in one sitting,” said Rachael. “For me, that outweighed contributing a little bit monthly!” Pet emergencies are scary situations and the added stress of a large vet bill can only add to the stress of the situation. When you have pet insurance, it takes a little bit of the worry away knowing that you can care for your pet whenever they may need it.

Vet accessibility is another pro of pet insurance. “When I first got pet insurance, I figured you’d have to take them to a specific vet similar to how human insurance is. We actually have the choice to take Layla to any veterinarian, hospital, or even specialist in the country!” said @laylathelovelyspangold’s mom, Brittany. This is a common practice, too. Unlike human insurance where you have to visit an in-network provider, most pet insurance companies work via reimbursement (more on that later), so you can visit any vet or specialist you’d like.

The Cons

Filing a pet insurance claim is typically quite a bit different from filing a human insurance claim. @_anybodyhaveamap_’s Gabriela told us that, “When researching, one thing that came as a surprise is you have to pay out of pocket for everything and insurance will reimburse you.” While this is how most pet insurance companies are able to let you visit any vet you want, this is the catch. Not everyone has the money to cover emergencies on the spot, but there are some exceptions. @dunegiants’ Stefani explained that, “Our company does have an option where you can have your veterinarian’s office fill out to have the insurance company pay them directly. We were able to do this with our puppy’s recent surgery. Since it was such a large bill, our vet office agreed we could do it this way.”

As discussed earlier, your monthly premium for pet insurance should be expected to rise as your pet gets older. In theory, the older your pet gets, the more susceptible they are to a variety of medical conditions so it makes sense that your premiums will rise over time. However, how much those premiums will rise is somewhat of a mystery when you first start out with insurance. Because of this, it’s hard to tell if pet insurance will be a feasible expense for you and your family a few years down the line.

Pet Insurance and Pre-Existing Conditions

Pre-existing conditions is a major thing to consider when considering pet insurance. With pet insurance, if your pet has a pre-existing condition any treatment related to the condition isn’t typically covered. This is another reason why getting insurance when your pet is young is usually a better deal–if your pet develops a condition after you’re insured, associated treatments and exams will be more likely to be covered.

On that note, another thing to consider is waiting periods. “There are often waiting periods for certain conditions like ACL injuries and hip dysplasia, meaning you have to be covered for 6 months or something similar before they will cover that,” explains Rachael. “So it’s really important to read the fine print and understand what’s included in your policy!”

One last thing to consider about your dog is their breed. Certain breeds or sizes will generally require more medical care. “I had to be careful which policy I got. Some plans have limits on their payouts and with our giant breeds… The costs add up fast,” explains Stefani. If you have a breed or size that typically ends up requiring a certain kind of care, make sure you read the fine print when it comes to payout limits on those services so you’re not surprised down the road.

Other Things to Consider

While there are many factors that play into your monthly premium for your pet, there are other perks that some pet insurance companies offer that might be worth spending a little extra money. For example, Pets Best offers a free vet helpline with their policies. This came in especially handy for us when our puppy started showing signs of what we thought might be a urinary tract infection late on a Friday night. We messaged the vet helpline and explained his symptoms, the vet agreed that a UTI might be the culprit, and told us we should try to get him into the vet as soon as possible. She even explained to us the best way to get a urine sample to take to the vet with us. The next morning when we called the vet to try to get him seen that day, we were able to say that we’d already talked to a vet, gotten a urine sample that morning, and that the vet said we should be seen, which we think helped us get a last-minute appointment within the hour to get him medicine.

Other benefits can include things like same-day reimbursements, or even direct vet pay where the company can pay your vet for you when you check out. These benefits vary between companies, so if you’re looking for something specific make sure to do your research.

Should I Get Pet Insurance?

In the end, it is ultimately your decision whether or not to get pet insurance for your furry family members. The cost is a big deal, but the peace of mind may outweigh those costs for you. If not, that’s okay too! You know what’s best for your pet, family, and lifestyle.